louisiana state inheritance tax

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Louisiana law used to require that an inheritance tax return be filed with the Louisiana Department of Revenue before a succession was opened.

Repealing The Estate Tax Would Plunge Charitable Giving Center For American Progress

With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a.

. It will cost you 345800. It is indexed for inflation and for deaths occurring in calendar year 2020 the exempt amount is 1158 million for an individual and twice that for a married couple. There is no estate tax in Louisiana.

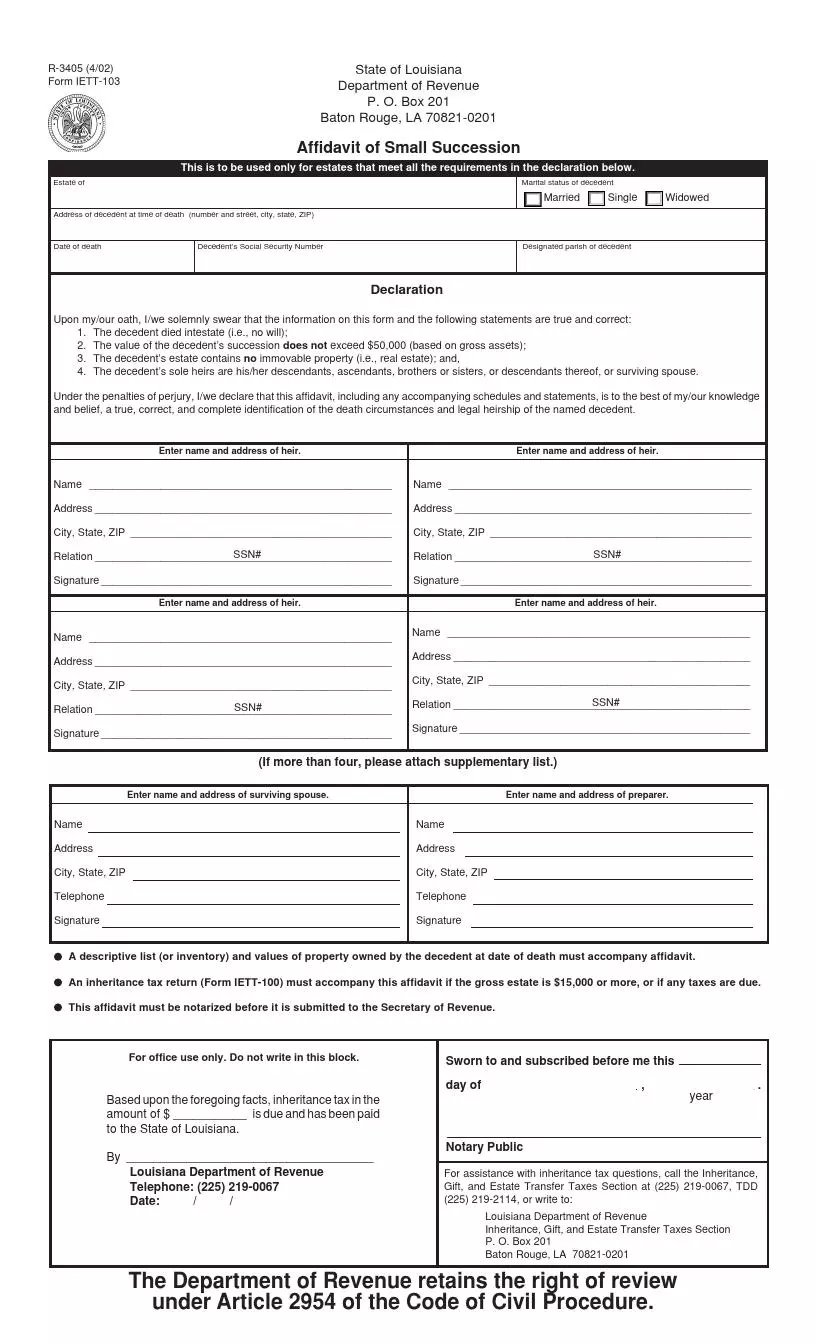

1 Total state death tax credit allowable Per US. Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the. An inheritance tax is a tax imposed on someone who inherits money from a deceased person.

R-3318 1108 1402 Schedule IV Tax Reduction and Determination of Louisiana Estate Transfer Tax 1 Total state death tax credit allowable Per US. There is a federal estate tax that may apply Menu burger Close thin. For the remaining 194 million.

Louisiana does not place a tax on estates or inheritances. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal capital gains tax 6 Louisiana top income tax rate. Federal Estate Tax Return Form 706 2.

First you will pay off the first 1 Million from the estate value. Like the Federal estate tax laws Louisianas inheritance tax laws have undergone a lot o See more. Equal to the maximum tax credit for state estate or inheritance tax allowed on the federal estate tax return Pick-up tax Since 2004 federal law allows only a deduction for state inheritance.

The Louisiana aspects to gift and estate. 1 Total state death tax credit allowable Per US. The Louisiana Department of.

Theres been a big change to the estate and gift tax rules for 2018. Well focus on the Louisiana components first and then the federal components. No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS.

Thus there is no requirement to file a return with the State and no state inheritance. To inherit the property you will have to clear off the taxes. Louisiana state inheritance tax.

However Louisiana is a community property state meaning that spouses jointly own all property acquired during a marriage. Effective January 1 2012 no receipts. LOUISIANA STATE INHERITANCE TAX The State of Louisiana has repealed all state inheritance taxes.

Under provisions of North Carolinas biennial budget bill signed by Governor Roy Cooper D on November 18 2021 the states flat income tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Inheritance Laws With a Will Louisiana probate is a process through which the courts recognize a persons last will and testament as valid enforce its terms and transfer.

Does Louisiana impose an inheritance tax. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal. The failure to plan for.

Inheritance taxes can apply regardless of whether the deceased person had a Louisiana Last Will and Testament or died intestate. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal. It is one of 38 states in the country that does not levy a tax on estates.

Renunciation Of An Inheritance In Louisiana Scott Vicknair Law

Estate Planning In Louisiana 4th Edition A Layman S Guide To Understanding Wills Trusts Probate Power Of Attorney Medicaid Living Wills Taxes Rabalais Paul A 9781985235168 Amazon Com Books

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Tips Advice Rabalais Estate Planning Llc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Louisiana Retirement Taxes And Economic Factors To Consider

Louisiana Petition For Possession And Affidavit Of Valuation And Detailed Descriptive List Louisiana Possession Us Legal Forms

State Estate And Inheritance Taxes Itep

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Louisiana Estate Planning Law Firm Losavio Dejean Llc

How Much Does Probate Cost Free Consultation

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Inheritance Laws What You Should Know Smartasset

Complete Guide To Probate In Louisiana

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It